IHT

Inheritance Tax: What Families Need to Know

Most families lose hundreds of thousands to Inheritance Tax.

We’ve created a structured 32-part educational video series exploring common inheritance tax misconceptions and key planning considerations.

Complimentary educational access

Why it matters?

Inheritance Tax (IHT) can have a significant impact on family wealth. Many estates are reduced more than expected simply because planning was left too late.

Unlike market fluctuations, IHT is largely shaped by structure and timing. The decisions made during your lifetime can materially affect what passes to the next generation.

From April 2027, proposed changes mean that certain pension arrangements may be included within the taxable estate. This could alter how pension wealth is treated for inheritance purposes and may create additional tax exposure in some cases.

For example, on a £1 million pension, combined tax effects could significantly reduce the amount ultimately received by beneficiaries, depending on individual circumstances.

Understanding how these rules interact is essential. The purpose of this series is to explain the landscape clearly, highlight common misunderstandings, and explore practical considerations.

IHT is often one of the most significant financial issues families face, and clarity is the first step toward better decisions.

IHT is the one of the biggest financial decisions of your life.

Doing nothing, or relying on generalists, costs families fortunes.

The right plan, done properly, can save your children hundreds of thousands.

Understanding the 2027 Pension Changes and Their Impact on Estates

Download the Market Insider Inheritance Tax Report to explore how structured planning may help families navigate the evolving rules.

Inside this report, you’ll find:

An overview of the proposed 2027 pension changes

How inheritance tax interacts with pension wealth

Common estate structuring considerations

A practical framework for thinking about long-term family wealth

Prepared by Ranjeet Singh BA MSc FCSI, this report provides clear, structured commentary drawn from over two decades of experience in financial markets.

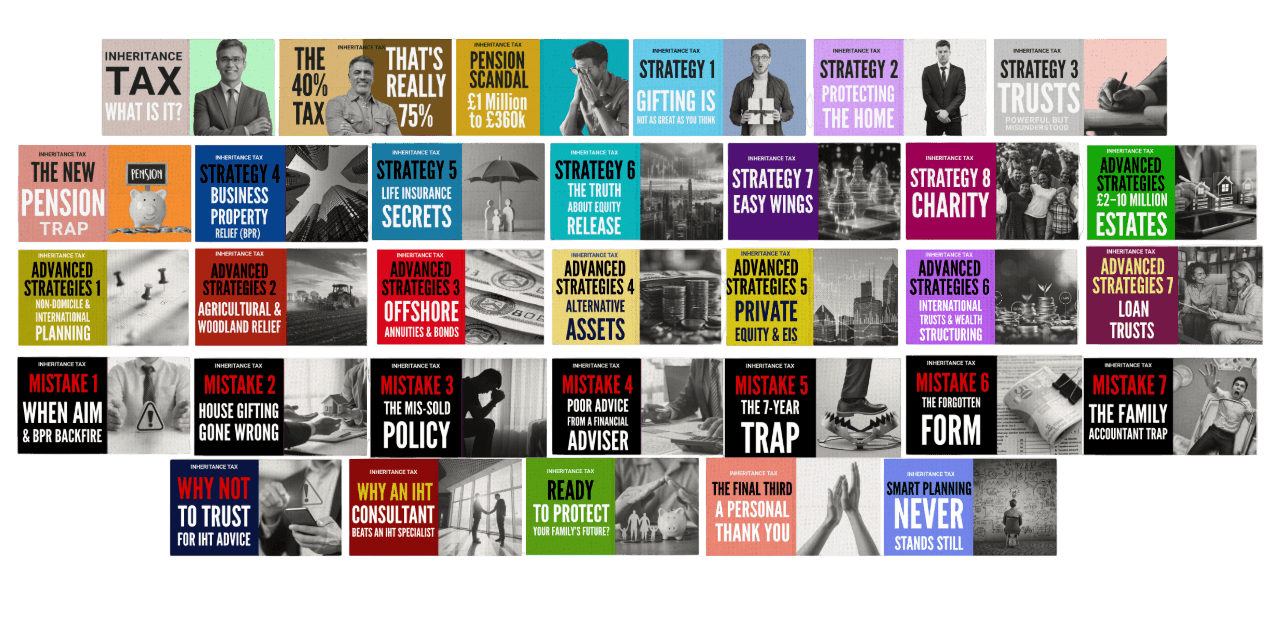

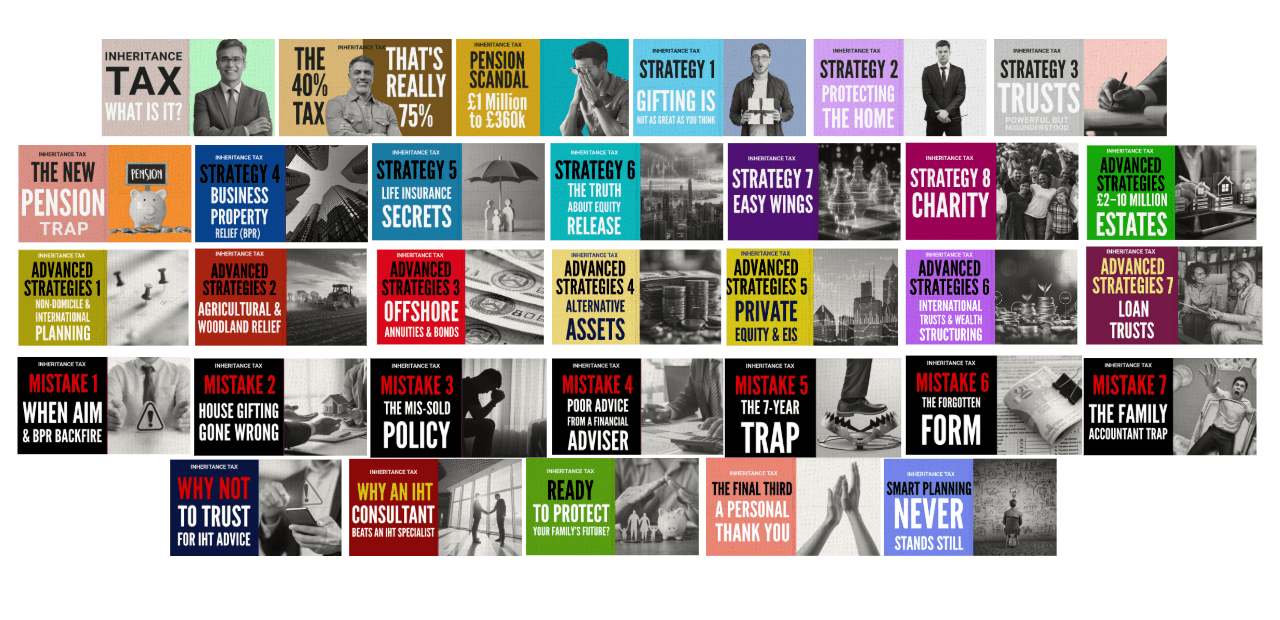

WHAT'S INSIDE THE SERIES

HERE'S JUST A TASTE OF WHAT YOU'LL DISCOVER IN THE 32 VIDEOS:

Foundations

What is Inheritance Tax (IHT)?

How Effective Tax Rates Can Exceed 40% in Certain Scenarios

Understanding the Nil Rate Band and Residence Nil Rate Band

The Impact of IHT on Pensions and Estates

Why IHT receipts have increased in recent years

Strategies

Gifting – rules, exemptions and documentation

Trusts – when they work and when they fail

Business Relief (BPR) & EIS – current qualifying rules

Equity release considerations

Using pensions, property, life insurance and charitable planning

Commonly used estate planning structures

Advanced Tactics

Non-domicile considerations

Agricultural & Woodland Relief

Alternative assets including gold and private equity

Enterprise Investment Schemes

Offshore pensions and annuities

Case Studies

Common estate planning mistakes

Poorly structured trust arrangements

Gifting strategies that failed

The 7-year rule and unexpected consequences

Administrative errors and their financial impact

You need a Tax Strategy - Not Tax Advice

WHY US

Right now, many families face complex Inheritance Tax decisions.

What they often need is a clear, structured plan before implementing solutions.

We provide independent research and strategic guidance to help you understand your options and the implications of each approach.

Rather than focusing on a single product or structure, we review the full picture and outline potential strategies. Where regulated advice is required, we introduce you to appropriately authorised specialists.

We do not sell financial products. Our role is to clarify the landscape, explain risks and opportunities, and help you move forward with confidence.

With over 25 years of experience in regulated financial services, we understand how small structural decisions can have significant long-term impact.

Inheritance Tax planning is complex, and early, informed planning can make a meaningful difference.

Correcting planning errors can add cost and complexity.

Unwinding trusts, restructuring portfolios, or revisiting gifting arrangements can require additional time and professional input.

Early decisions can have long-term consequences.

Once certain steps are taken, reversing them may not always be straightforward. Careful planning at the outset matters.

A structured approach reduces avoidable mistakes.

Our role is to help you understand the landscape before committing to any solution.

We simplify complex rules and

structures.

Tax allowances, exemptions, and legal frameworks can feel overwhelming. We translate them into clear, practical guidance.

We focus on your family’s long-term objectives.

Effective planning aligns tax efficiency with personal values, legacy goals, and family dynamics.

Ready to Protect your Family Future?

WHY JOIN THIS TRAINING?

Get Instant Access to the Full 32-Part Inheritance Tax Video Series

This structured training explains how inheritance tax planning works in practice, not just in theory.

Through short, practical videos, you will gain a clearer understanding of the key strategies, common mistakes, and planning considerations that can affect how much of your estate ultimately passes to your family.

Free to access. No obligation.

You can review the material at your own pace and decide your next steps with confidence.

Learn from experience in IHT planning.

You’ll gain practical insight into the strategies, structures and considerations involved in estate planning.

Where appropriate, we can introduce you to qualified specialists for regulated advice.

A broader perspective on IHT.

Many families receive fragmented guidance. This training helps you see the full picture before implementing any solution.

Inheritance Tax Educational Videos

A collection of educational discussions designed to help experienced investors think more clearly about portfolio structure, risk and long-term planning.

Educational Notice:

These videos are provided for general educational purposes only. They offer an overview of inheritance tax and estate planning concepts and should not be relied upon as tax, investment or legal advice.

Ranjeet is not a tax adviser. The views expressed are his personal interpretation of the tax landscape, presented in a straightforward and intentionally light-hearted style to make complex topics easier to understand.

Tax legislation changes over time, and some information may not reflect current rules or individual circumstances. You should seek advice from a suitably authorised professional before making any financial or tax decisions.

© Market Insider 2026

Access the 32-Part Inheritance Tax Education Series

Discover how UK families are reducing avoidable inheritance tax using structured, strategic planning.

Enter your details below for instant access to the video series and accompanying reports.

✔ Understand how inheritance tax really works

✓ Pension changes from 2027 explained

✓ Common mistakes that cost families hundreds of thousands

✓ Practical planning structures used by experienced families

✓ 32 short videos with supporting written reports

Instant access — watch the video series immediately after submitting the form.

Educational access provided at no cost.

This video series is provided for educational purposes only and does not constitute financial, tax or legal advice. Tax treatment depends on individual circumstances and may change. Please seek appropriate professional advice before taking action.

We respect your privacy.

Your details will never be shared.

Protect Your Family’s Wealth — Before HMRC Takes Its Share

Download the Market Insider Inheritance Tax Report and learn how successful families are protecting their estates using

The Seven Pillars of IHT Planning.

This report is for educational purposes only and does not constitute financial, tax or legal advice. Tax treatment depends on individual circumstances and may change. Please seek appropriate professional advice before making decisions.

By submitting your details, you agree to receive related communications. You can unsubscribe at any time.

We HATE spam. Your email address is 100% secure