CUSTOMER SUCCESS

From our FCA-Regulated

Wealth Management Firm

(2008-2024)

Over 16 years, we’ve managed 700+ clients using the DIP Strategy through our FCA-regulated firm. Now, it’s available to investors who want to manage their own portfolio.

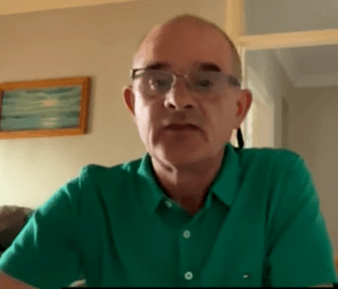

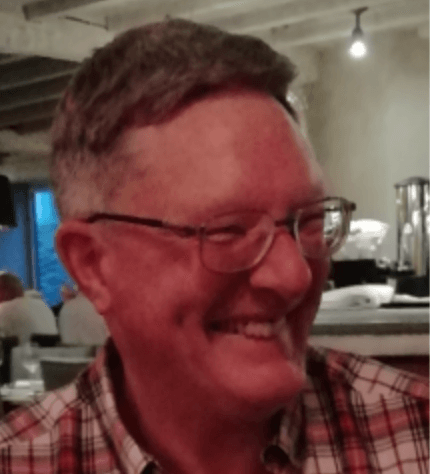

CASE STUDY 1

Chris Minter, Retired, Fulham

"I chose you because I knew you could get the job done..."

A True Gentleman and a Valued Client – Christopher Minter’s Story

Christopher Minter is quite the character and has been a valued client of ours since 2014.

He lives in Fulham, West London, with his wonderfully charming wife, Lynda, and over the years, we’ve built more than just a professional relationship—we’ve built a friendship.

Born in 1933, Chris has the energy and sharpness of someone twenty years younger. His quick wit, keen intellect, and infectious sense of humour make every conversation with him a pleasure. Never one to miss a celebration, he’s already making plans for his 90th birthday—and we’re honoured to be on the guest list!

We believe that great portfolios start with great relationships, and Chris is proof of that. He’s an experienced and savvy investor, having bought his first shares in Tesco for just 25p back in 1947. His passion for investing took him all the way to Hong Kong, where he spent 14 years in media and advertising before turning his attention fully to the stock market.

To this day, he still sends us brilliant stock ideas, and we often joke that he should come out of retirement and join the team! With careful planning, Chris and Lynda have built an impressive £5m property portfolio and a strong, income-generating share portfolio with our help and that of Rathbones.

Over the years, many wealth management firms have approached Chris, keen to handle his investments. But when asked why he chose us, his response was simple:

“I chose you because I knew you could do the job. I wasn’t looking to get rich, I just wanted a firm with values that I could trust.”

Chris understands the ups and downs of the market. He didn’t expect to always make money, but he wanted his advisor to have his best interests at heart. That’s why he’s stayed with us—and why we are so proud to work with him.

Now, with his investments taken care of, Chris has more time for the things he loves—hitting the gym, reading military history, and enjoying a good glass of red wine with friends.

At the end of the day, a fulfilling life starts with a solid plan, and Chris is living proof that with the right approach, you can turn your goals into reality.

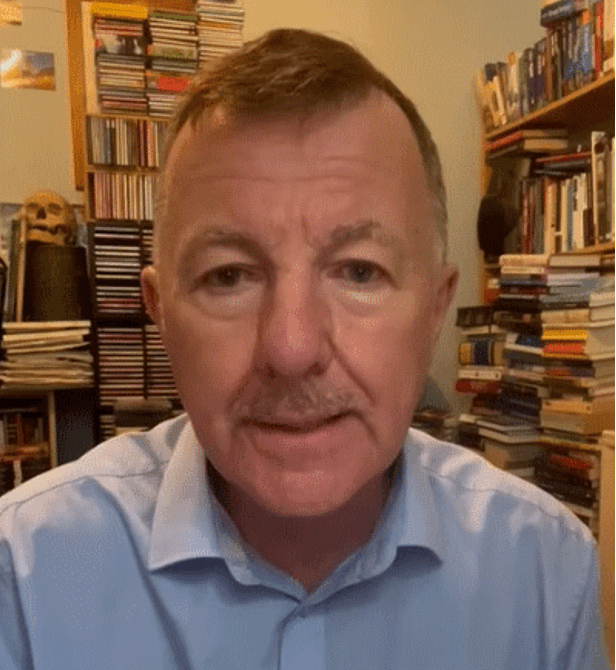

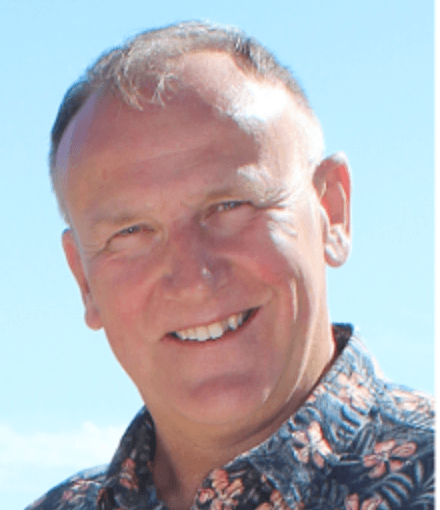

CASE STUDY 2

Tim Ede, IT Professional, Newbury

"I've been with the firm for a few months now and they've just blown me away with what they've done."

My name is Tim and I've been interested in trading shares for quite a while and have a pretty good level of knowledge already. I was very interested in the DIP strategy and after I got a copy of the DIP Book. I read the DIP book cover to cover within two weeks and enjoyed every minute of it.

I like the idea of investing in solid blue-chip companies with dividends, whilst minimising risk and maximising on profits. It just made sense to me straight away. I signed up for the full 30-day online trading course which was brilliant, and which gave even more insight into the DIP strategy. It was hard work but also so rewarding because now I really understand the strategy fully.

My background is that I'm 56 years old, a trio of older kids and a keen road cyclist. I've worked in IT for more than 30 years, so I'm a technically minded person. Technical analysis and spreadsheets come easily to me, and I keep accurate numbers of all my own trades and investments. I even created my own spreadsheet for the DIP strategy calculations which Ranjeet was really impressed with. We met for a coffee and sat down for about 90 minutes going through everything.

He's a very personable guy and straight away I knew that he and his team were the perfect fit for what I was looking for. I'm heading towards retirement in the next 2-4 years, and I wanted to find a personal wealth management firm that I could really trust and get the personal touch.

For me there's no doubt now that I made the right decision.

Within a few days of moving my share portfolio to LSS, they immediately laid out a complete investment strategy just for me, using the DIP principals, my own risk profile, and what my goals were. They're a great fit for what I was looking for and I'm hoping that we will be working even closer together in the future.

Before using their services, I had been watching their online content and always found it useful. I also attended several of their online webinars and was really impressed with their level of knowledge and the community that they've built over the years. It's like a group of like-minded investors all looking to regularly make great profits using a realistic and effective strategy.

I've been with the firm for a few months now and they've just blown me away with what they've done. We have had a lot of success, they’ve identified 14 trades, 10 have completed and made money, averaging between 4-16% return. The other 4 are still open, but they also look positive.

What's most surprising, is that this has all happened at a time when most people were losing money in the stock market. I regularly watch the news, the recession, high inflation, energy and food bills going up, rising interest rates etc. and then I look at my portfolio and I’m happy. I used to be quite concerned that my investment portfolio wasn’t performing, and whilst I know things are never guaranteed, I’m quite content that it is now on the right track.

I am so impressed I have already recommended a good friend of mine to them as he is in a similar position that I was in 6 months ago. I always knew that I didn't want to work with a big wealth management company and just be a faceless number, they are just too expensive and impersonal.

I also didn't want to spend my retirement worrying in front of a screen and managing the minutia of my portfolio. In the end I found just what I was looking for, an independent, honest, UK firm with great knowledge and a family ethos.

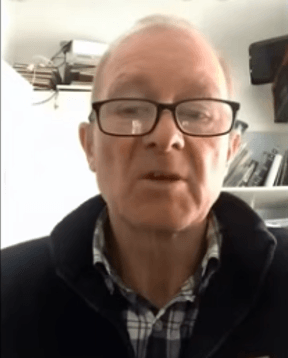

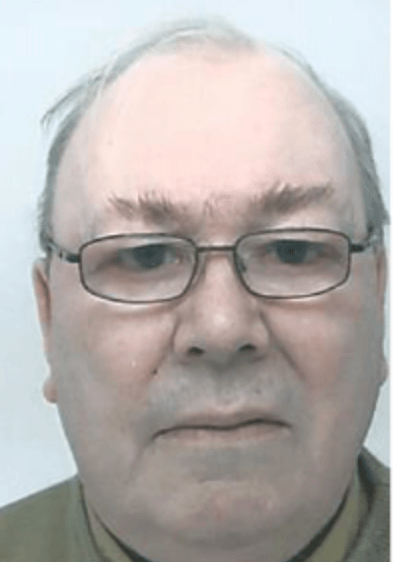

CASE STUDY 3

Jon Pilcher, Systems Manager, Worthing

"Honestly, they're brilliant..... I have no reservations in recommending them..""

In 2014, my role as a Systems Integration Group Manager was made redundant, and rather than taking up a new position, I decided to take the lump sum offer. I also took direct control of my company pensions via a SIPP, and consequently had to take investing more seriously.

It's a running joke that I have consumed more content from them than anybody else.

Honestly, they're brilliant.

Chris is my account manager and he's fantastic. We've been speaking since early 2015 and I get access to all of the videos, webinars, strategies for free.

I have learned so much from their team, including how to short and make money in falling markets. When others were losing 10-30% money during Covid and the Russia-Ukraine conflict, I actually slightly increased my portfolio profit.

As a humble retail investor, I wasn't sure that was possible, but it really is.

I'm also a fan of the DIP strategy. I read the book (twice!), watched the training videos, all of which proved well worth the time invested. I even put together a spreadsheet based on principles gleaned from the DIP.

My retirement is a lot more fun because I'm in control of my money and a big thank you has to go to the team for that. I have no reservations in recommending them either for more of an advisory role or direct portfolio management.

CASE STUDY 4

Dom Fasino, Retired, Sutton

"He's as honest and straight as you will find...if you have an opportunity to work with Ranjeet or his team, I recommend you do it."

My name's Dom and I'm 73 years old. I came across the DIP Strategy and their firm quite recently and read the book. Unfortunately I didn't understand all of it because I don't have a lot of experience in the stock market.

However I do have a lot of experience dealing with people and I know that their staff are genuine. I spoke to Ranjeet, the owner, and author of the DIP, and we worked out that unfortunately I wasn't able to use his services because my portfolio wasn't quite big enough.

But that didn't stop him from giving me some free information and advice which has been really helpful. I was nearly conned a few years ago by a company but I smelled a rat and didn't invest. So I have a good idea of when I'm being lied to and when somebody is out for themselves.

My Aviva pension hasn't done very well in recent years and Ranjeet gave some great free advice on what I could do to improve it. He didn't earn a single penny in commission so he could have easily just walked away and ignored me. But instead he actually took the time out to help me.

And here's what I like the most. Ranjeet spoke to me several times after that even though he knew that he wasn't going to make any money out of me and that I couldn't be one of his clients. He even gave me his direct telephone line and told me that if anybody tries to scam me again, for me to call him.

I'm hoping one day that we can do business together in the future but for now I'm just happy that I've built a great relationship with a firm that I can trust.

If you have an opportunity to work with Ranjeet and his team I recommend that you do it.

I can't talk about his performance or anything like that, but I can tell you that as a person he's as honest and straight as you will find. And for me that's more important than anything else.

CASE STUDY 5

Simon Gatti, Retired, Tottenham

"..We were losing more than £6,000 a month on inflation from our £750,000 cash savings....then we learned about the DIP and everything changed...."

My wife, Mimi and I, had recently sold a property and had a significant sum of cash sitting in the bank for several months. With rising inflation we were becoming more and more agitated but really didn’t know where to turn.

After considering lots of different firms and investment strategies, we came across the Dividend Income Plus approach, and so I bought the book. As soon as I received it, I read the whole thing cover to cover in one evening.I was really impressed by the strategy, it just made so much sense.

I immediately set up a meeting with them at their offices in Royal Exchange and after all of my questions I just felt sure that this was the firm I wanted to work with. There was no pressure, no sales, just really honest, straight talking.

They took the time to really understand our unique position with all of the different parts of our goals, our concerns, and what we wanted. Within the space of a couple of days we had transferred all of the £750,000 to them. It sounded like a sudden decision but in fact it was a well-thought out decision that started even before we sold the house. We had already considered all of the different risks and it was clear to us that investing in the stock market even with the risk of our capital falling in value, was better than losing money to inflation. We weren’t disappointed.

In the first few days of transferring the funds, our advisor discussed a solid investment plan of how the money could be invested. He gave various options and we both agreed on the one that suited us best. It was exactly what we were looking for. Since then we’ve been receiving regular emails, and the occasional telephone call to keep us abreast of everything.

It’s been a really positive experience and we couldn’t be happier. Mimi and I have never expected huge returns, we’ve always been careful. We just want to beat inflation, get some regular income and a bit of capital appreciation. That’s what we are now getting. With the first few trades they have already exceeded all of our expectations. The first trade was up by more than 50%. I know that’s highly uncommon but it was nice to see was that our advisor didn’t rush and sell it. In fact he told us to be patient and wait for an even bigger return. We also know that performance is a long term game, not short term. And we expect there to be losses too. What’s most important for us is what we’ve always been looking for which is peace of mind. Finally with so many financial companies out there trying to get our business, we found a really competent team of advisors who we trust and are doing everything that we expect of them.

Investing isn’t the hard part, it’s finding the right firm to work with.

CASE STUDY 6

Leo Mattei, Health Consultant, Rome (Italy)

"...I was blown away with his generosity...He never tried to sell me anything...

My story is quite unique because my girlfriend used to be an au pair for Ranjeet's children. One day Ranjeet invited me for dinner and we got chatting.

I was born and lived all of my life in a little village called L’Acquila, about an hour’s drive from Rome, in Italy. I work as a consultant helping employers with health and safety, but I’ve always been interested in finance.

My dad is a retired stockbroker and so I've always wanted to learn about the stock market, but I had no idea about Ranjeet's background.

When I asked him whether he could teach me anything about investing, he shocked me by saying that he would give me a free copy of his DIP book and that I could enrol on his 30-day course for FREE! I was blown away with his generosity. I checked the course price online and it was £4,950!

I couldn't believe that he was giving it to me for nothing.

I read the book and a few weeks later I did the full course and found it really interesting. There were so many things that I just didn't know, and the book explained it perfectly. I don't speak English as a first language, but it was written in a way that was easy to understand.

I just wanted to share these few words because most people know Ranjeet as a financial professional, stock expert, businessperson etc. but having spent a bit of time with him that evening over dinner, I saw a very different side.

Not once did he ask me for any money, to invest money with him, and he never tried to sell me anything.

He could have asked for maybe a small payment of maybe £200 for the course and I would have said yes, but he insisted that I do it for free. It was just a kind and honest gesture.

I wish him and his family the best for the future. Thank you Ranjeet for re-igniting my interest in investing again and for teaching me about the DIP.

CASE STUDY 7

Mr and Mrs Norman Hunter, Retired, Hampton

"Since the book arrived, I haven't been able to put it down..."

My wife and I are in our mid 60s and we have an investment portfolio which we took out more than 10 years ago, but it hasn't really performed.

When we saw their advert in the Richmond magazine, we immediately took up the offer of getting their free DIP book.

Since the book arrived, I haven't been able to put it down.

It's very informative and easy to follow and I wish I had known about this strategy years ago. Unfortunately, my total portfolio is still under their minimum threshold but despite this, their team continue to support and help me which shows the kind of company that they are.

They just want to help, and it doesn’t matter if you’re a big or small investor. They don’t even care if you’re going to be a massive pay cheque to them or if you’re no pay cheque to them at all, like me!

Of course, we'd love to work with the team, and I spoke to Ranjeet personally so let's see what the future holds. Hopefully one day!”

CASE STUDY 8

Mr and Mrs Ian Thompson, Retired, Ampthill

"..I have been investing for many years and have learnt quite a lot, but I still need advice along with another opinion at times.."

I have been investing for many years and have learnt quite a lot, but I still need advice along with another opinion at times.

I placed some of my portfolio with Ranjeet's stockbroker firm about three years ago and it has been volatile at times but Ranjeet is always approachable which I appreciate, and he accepts advice at times from myself having trod life’s path for some 63 years of marriage.

One item I emphasised to him which he took on board was ‘Keep your Promises’ which he has taped to his office desk and in my view has made him more efficient.

I thoroughly enjoyed reading his DIP book which I keep for reference and use it from time to time.

CASE STUDY 9

Paul Molina, Retired Electrician, Markyate

...It's as good as any strategy you'll find, and if you're looking for dividends it's the best one that I know of...

I'm fascinated with stock prices and I've read just about everything. I've got more than 100 investment books in my house and I've read them all, some of more than once!

I've been trading since 2012 and I currently use Vectorvest for my trading signals. I also subscribe to Stockopedia, Sharescope and I've joined a number of investment clubs so you could say I've 'been around'. I'm also an active member of my local DIY investment club, where I meet up every month with another 20 investors, at Wallingford.

When I read the DIP book straight away I loved it and it's definitely in my top 10 of all the books that I've read. That's saying something given that I've read books by Warren Buffet and Ray Dalio!

It's quite strange really as the DIP is not a strategy that I would normally consider. I don't like dividends, I'm a buy and hold investor and I never sell - basically I'm the polar opposite of the DIP investor! But something with this strategy really resonated with me. That's how powerful it is.

At least three other people in my club have already bought the book and so the word is spreading fast! And I know it's going to get bigger from here.

I go to all of the investor shows each year, Master Investor Show, London Investor Show, and at least half a dozen trader shows. I love meeting people and I'm constantly reading and learning.

As somebody who takes information from everywhere and everybody, I've got a good sense of what works and what doesn't. And I can tell you that the DIP is right up there. It's as good as any strategy you'll find, and if you're looking for dividends it's the best one that I know of.

Just recently I met Ranjeet and his team at the Trader Investor Show in Holborn, Central London. What a great bunch of people they are.

I went to his 30 minute presentation and the room was completely packed, it was so busy. It was one of the most popular talks of the day and at the end Ranjeet got a massive round of applause and everybody wanted to speak to him. He made time for everybody, signing copies of his book and sharing his knowledge.

Brilliant guy, and a brilliant team he's built at his wealth management firm.

By the way, if you don't get a chance to meet Ranjeet in person, make sure you watch his free, online trading videos. I love them - quick to the point, and loads of nuggets in there too!

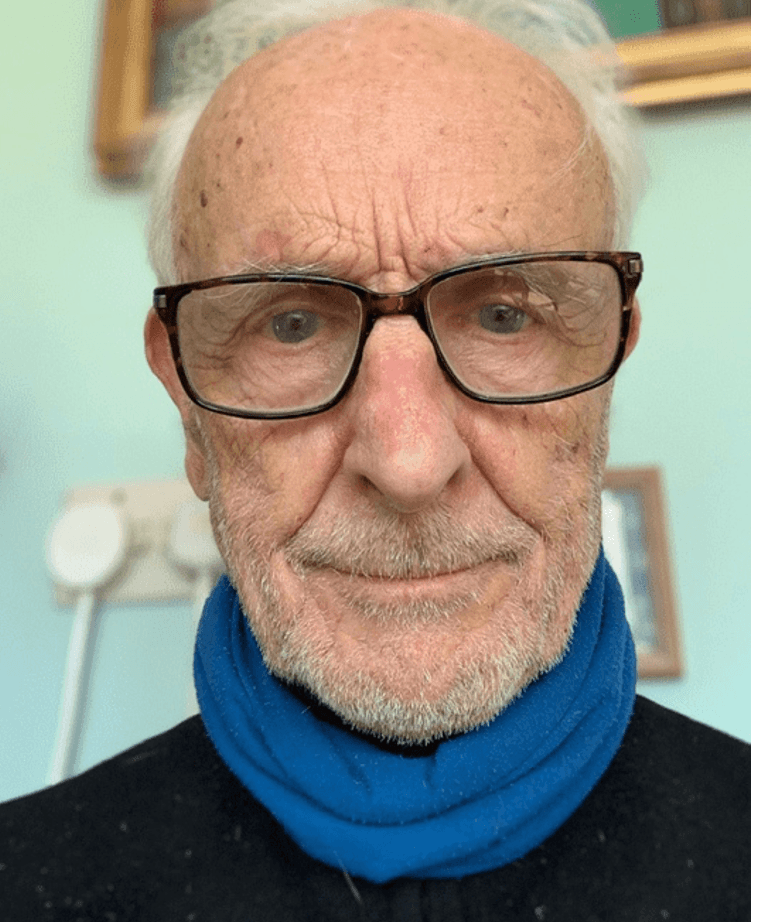

CASE STUDY 10

Peter Blower, Retired, Sheffield

"I have been an avid investor for over 35 years during my career in Law...and I've found Ranjeet to be personable, efficient and courteous at all times."

I have been an avid investor for over 35 years during my career in Law and subsequently in retirement. I have spoken to the author on many occasions in the last few years and have found him to be personable, efficient and courteous at all times.

I've read both the DIP book and the 13 secrets book and they're both fantastic.

He appears to have an excellent knowledge of the workings of the financial world and he describes it so well in his writing.

The 2nd book (Insider Secrets) is a must read for the elderly such as myself as it highlights the mechanisms legal and illegal that some people in the financial world can stoop to, to engineer a placement, sale etc.

The book is essential reading for all those considering making financial investments in the present turbulent times.

Ranjeet really lifts the lid on the financial services industry as a whole. It is an in-depth look at the way the industry self regulates but leaves the door wide open for the unscrupulous and fraudulent across the whole industry.

The book sets out the way the dishonest can easily manipulate the system for their own ends. A truly fascinating read.

CASE STUDY 11

Batuk Ruparelia, Retired Medical Rep, Harrow

"That's how confident I am that this wealth management team is the best one you're going to come across. Trust me, I've spoken to pretty much all of them!"

I'm 75 years old and have lived in North London for most of my life. I used to work as a medical rep, I was a business owner and I've done lots of jobs in between so I've built up a decent share portfolio over many years. I came across Ranjeet's stock broker firm about a year ago after searching online for a London based stockbroker firm.

I quickly found and read the DIP book and it was incredible - it just taught me so much even though I've been investing since the early 1990s.

Earlier this year I went to the London IX Trade Show and met Chris and some of the team, and they were all amazing. Friendly, funny, really switched on, they knew their stuff but they talk to you like a real person - not like a sales target.

There's no false smiles or dishonesty with them.

To be fair, I wasn't really looking to use their services. I just wanted to see what was out there and get some free expert tips to help me with my trading strategy.

I already have a pretty decent portfolio and I've always managed my own investments with my brother and we're both quite experienced.

We've made quite good money over the years. We use Hargreaves Lansdowne as a platform, and we're members of Motley Fool so we get lots of good information. But after seeing what Ranjeet and his team were doing, it really made me wake up to the possibility that there was so much I was still missing.

I've been using some of their basic, entry-level strategies and have seen great results over a short period of time. That's why I know that they're the real deal.

Because I'm an experienced investor myself, I know when somebody is trying to bluff it and the investment managers who actually know their stuff.

If you're thinking about learning or investing and want an honest firm, then you can stop looking. Ranjeet and his team are your answer. They don't deal with certain products that I like to trade in which is a bit of a downer, but the stuff that they do, I think they do better than anybody else.

Today, I can pick up the phone and speak to any of their team as if I'm an old friend. I'm going on the 30-day DIP course soon with my brother and I'm excited about what the future holds.

That's all I have to say - they're all just brilliant. Thank you to everybody.

If anybody wants to reach out to me to make sure that I'm a real person and a genuine fan of theirs, not some AI robot!, I've told the team to feel free to pass on my details!

That's how confident I am that this wealth management team is the best one you're going to come across. Trust me, I've spoken to pretty much all of them!

CASE STUDY 12

Marcus Pilleau, Commercial Investor, Hampshire

"...I meet with my advisor on a regular basis at his City Offices to review performance.."

I run a SME sized family Property Company that was incorporated some 30 years ago.

We invest in all sectors of property and which has also included, for the last 10 years, a substantial Share Portfolio.

In 2017 I opened a personal ISA with Ranjeet and the following year I transferred our Company Share Portfolio to him with the brief that it was required to generate an income equivalent to the rent from our standard residential letting, plus an average capital gain of 5% pa.

I meet with my advisor on a regular basis at his City Offices to review the performance of the portfolio and current market conditions, and to discuss future strategy and alternative investments.

Between meetings I also have regular telephone briefings and which has proved most beneficial in the current Coronavirus climate.

Finally, the back office staff are efficient, friendly and courteous.

In summary, Ranjeet and his team are a small, proactive and successful stockbroker.

I would strongly recommend them for those individuals and companies who do not have the time, or necessary skills to manage their own stock portfolio.

CASE STUDY 13

Mark De Wale, Richmond

"I found Ranjeet online and that saved me...I short-cut my way thanks to the DIP Strategy"

With the book and the videos, it's like I'm getting personal mentoring. It's brilliant. And finally I'm starting to see some real progress...

I've never had any previous dealings with brokers and so it's hard to compare Ranjeet and his team with anybody else. But I'll tell you my story very quickly.

So I started dipping my toe in the stock market in 2019 as a complete novice. I didn't even know what the difference between a stock and a fund was, or what a spread was, or what a market maker did - it was all new to me.

At the time I was with Barclays ISA Investments and started trading for myself.

I was trying to get to grips with all of it but it was way over my head. I was running limit orders without even understanding what they were.

But I wanted to make back for all the lost time I hadn't been investing, and so I just dived in, without any strategy - head first! Well, that didn't end well.

Luckily, I found Ranjeet online and that saved me.

I think I was also really lucky because Ranjeet lives in Richmond and so we are practically neighbours.

I started realy late in the investment world but I feel that now I am streets ahead of most investors just because I managed to short-cut my way thanks to the DIP Strategy and Ranjeet's help.

CASE STUDY 14

Stephen White, Doctor, Belfast

"I’ve definitely benefited through their excellent videos and webinars"

I’m a married, 63 year old eye surgeon in Belfast still working away. I have a number of outside interests and one of them is the stock market.

Looking back, I must have had an interest as a teenager as I clearly recall a visit I made to the (now long gone) Liverpool Stock Exchange, in my home city. I still recall a pervasive air of gloom and various men in suits telling me how bad things were.

Well, it was the 1970s! I then excitedly pursued a career in medicine and actually had no interest at all in money, save only in spending it, until 6 years ago!!

I really was astonishingly ignorant and had no savings in ISAs and, I’m ashamed to admit, I believed that my final salary pension would actually equal my final salary. I know. I can scarcely believe it myself now. I quite suddenly realised that I’d better get a grip to make sure my family would be ok and that I would have a secure retirement.

I paid a lot to a financial adviser but noticed the high annual fees and left after a year as I honestly felt I could manage on my own and I certainly felt I was the one with my own interests most at heart.

I read everything I could get my hands on and started investing as much as I could afford. And, yes, of course, there have been bumps along the way but no disasters. I have taken it seriously but it is fun and interesting.

I’ve definitely benefited from Ranjeet's excellent videos and webinars, though I do have an obsession with taking decisions myself - then any mistakes are mine!

Thanks to Ranjeet, Chris and the team. And here’s to the next Bull market!

CASE STUDY 15

Bikash Acharjee, Ex-Lawyer, North London

"..He stopped me and uttered the words that brought tears to my eyes, "I'm going to help you..."

At the London Investor Show in October 2023, I had the good fortune to meet Mr. Ranjeet Singh, a featured speaker at the event. Naturally, he was quite busy interacting with other investors and, like myself, inexperienced traders.

Despite his busy schedule, I managed to chat with him briefly and even obtain signed copies of two of his popular trading and investment books:"Dividend Income Plus: Investing In The Stock Market Shouldn't Be Difficult" and "13 Insider Trading Secrets That Will Blow Your Mind".

It was my first chance to talk to such a successful city trader and prolific author! I only wish I could have gotten a photo with him to commemorate the encounter.

Leaving the London Investor Show, a wave of nostalgia washed over me. It was exactly 20 years ago that I arrived in the UK, a bright-eyed international student embarking on an intensive legal training programme. My future as a successful commercial lawyer seemed pre-ordained.

After all, I graduated from a top law school in India and even worked alongside a distinguished international lawyer. Everyone anticipated a thriving legal career.

But life, as they say, rarely follows a straight path. Visa restrictions made securing a suitable job placement a frustrating ordeal. Then, just as I felt the tide turning, a devastating blow struck. I lost both my parents within a short period, plunging me into a period of deep despair.

The future I envisioned shattered, I was left questioning everything: returning back home, of staying in the UK, and even the very purpose of my life.

Unfortunately, regaining my lost self-esteem proved elusive. It seemed like every step forward was met with another setback. My restaurant venture folded, the law firm lost its legal aid contract, and most recently, the COVID-19 pandemic resulted in my redundancy.

Now, I find myself primarily managing our young family while my wife works. It's a challenging role, and the uncertaintly about my future career path weighs heavily. However, the ability to earn from home offers a glimmer of hope. Freelance legal consulting is an option, but the allure of financial markets – trading stocks and cryptocurrency – beckons.

The desire to learn new skills like stock or crypto trading is undeniably strong. However, mastering anything requires focus, a luxury in short supply with a young family. This reality was painfully underscored when, sleep-deprived one night, I fell victim to a phishing scam from a Dubai-based NFT company, losing £4500 from my Metamask wallet.

It's true, the path to financial security feels riddled with obstacles. I've explored various avenues – property investment, rent-to-rent schemes, cryptocurrency, day trading – attending conferences and devouring books along the way.

Yet, replicating past successes hasn't materialised. Like many others, we're simply making ends meet amidst rising costs, our small London rental a constant reminder of the financial tightrope we walk. The inability to financially support loved ones, as I once could, adds another layer of strain.

Despite our financial constraints, we're fiercely committed to saving for our children's future. This summer, we're hoping to travel to a specialised hospital in South India for intensive therapy for our autistic son with a severe speech delay. This treatment could significantly improve his life. Every penny I earn goes towards that goal – a chance for him to live a more fulfilling life.

That's why finishing "Dividend Income Plus" and meeting Mr. Ranjeet Singh at the Investor Show felt so impactful. Having followed his work, I see the DIP course as a potential turning point. Maybe, just maybe, this is the key to securing our family's finanical future and ensuring my son receives the treatment he desperately needs.

It's a chance worth taking.

The road ahead seems daunting. Our current porfolio of only £5,000 falls far short of the minimum required to become Mr. Singh's client, which I heard starts from £100,000. This financial constraint felt like yet another dead end, a crushing blow to my hopes.

Then, something extraordinary happened. Out of the blue, Mr. Singh called me.

While he didn't initially recall our meeting at the Investory Show, I explained our brief encounter. He then inquired about my portfolio size, and upon learning it was just £5,000, I braced myself for the inevitable disconnection.

But the call didn't end. For the next half hour, we spoke at length. I shared my story, much like I've shared it with you. To my astonishment, Mr Singh listened intently. Finally, he stopped me and uttered the words that brought tears to my eyes: "I'm going to help you."

Instead of the discounted £2500 course fee, he offered me access for a mere £100. Even more incredibly, he requested I donate that amount to a charity of my choice! Overwhelmed with gratitude, I stammered questions about his motivations.

His simple reply resonated deeply: "Because we all need help sometimes."

The generosity of this large-hearted man has reignited a spark of hope within me.

While I can't vouch yet for the specific results of his strategy, his performance, how much money he might make you, one thing is crystal clear: Mr. Singh's compassion is undeniable.

He has offered me a fishing rod, not a fish, and I am determined to use it to its full potential, to rewrite my destiny and secure a brighter future for my family.

CASE STUDY 16

John Hutton, Retired, Fulford

"They made me 27% profit on Bellway and 20% on Rolls Royce...my total portfolio is up by 8% in less than 5 months which I'm very happy with.."

My background is in academia and some financial institutions. I'm 80+ years old and live in York.

I've been with Ranjeet's wealth management firm, London Stone for about 6 months after being disappointed with my high street bank portfolio. I wasn't happy being quite heavily invested in UK gilts and bonds with interest rates going up, and after reviewing my investments we worked out that my recent rate of return was just 2%.

That's less than I could have earned in a savings account.

So, I decided to try the team at London Stone. They've picked some good stocks and so far, they've made my portfolio grow nicely. I receive regular trade emails and market updates, which means that if I don't log into my account for a few weeks, I'm still being kept up to date.

They have great communication by phone and email, and I have my own personal account manager whom I can speak to when I want.

Recently they made me 27% profit on shares in Bellway and 20% on Rolls Royce and there are several others which are making good profits. So far, my total portfolio is up by just under 8% in less than 5 months, which I'm very happy with, though I realise that could change either way.

The stocks that my advisor buys are almost exclusively blue-chip dividend payers and they follow their own strategy called the DIP.

I've read the book and can see the benefit of a systematic approach. I hope to be able to add more funds to their account in the coming months, provided of course that my portfolio continues to grow satisfactorily.

From start to finish it took me almost a year to decide to invest with Ranjeet, and I had quite a few calls, emails and meetings. I feel more confident now.

Another benefit which I didn't think of at the time is that in the process of shifting funds, I changed my bank portfolio to a more proactive stance. I've been with them for more than 20 years, but they are now performing much better.

Possibly the competition helps.

CASE STUDY 17

Ken Noble, Retired, Blyth

"They are a great company to work with.."

May I say they are a great company to work with.

My advisor spends a lot of time on giving good advice and nothing is a problem to them at all.

It is an absolute pleasure to be able to deal with people who are so approachable. All I can do is highly recommend London Stone and their staff.

CASE STUDY 18

Trevor Peterson, Retired, Bradford

"They are a great company to work with.."

I was managing my portfolio with Hargreaves Lansdown on an execution only basis but found that I was not giving my portfolio the time that it needed and so I kept missing opportunities which was affecting the performance.

I also realised that I did not have the expertise to get the most out of my investments and so I began looking for a firm that could help me.

Since transferring my portfolio to London Stone, my broker immediately got to work on restructuring it and by doing so he’s enabled me to increase my dividends by up to 30% on some of the shares, but at the same time he has also reduced the overall risk of the portfolio.

I would thoroughly recommend them to anybody who wants their investments to perform better.

CASE STUDY 19

Wendy Cowley, Retired, Oxford

"I have nothing but praise for them, 10/10."

I have no experience with investments and they have taken care of my money for me.

They contact me every four weeks, on a regular basis, to update me, to move my finances around according to the index.

I have nothing but praise for them, 10/10, so thank you very much

CASE STUDY 20

Barry Hindhaugh, Retired, Scottish Borders

"I couldn't fault them whatsoever, and I would thorougly recommend them."

When my investments very doing very poorly, I moved them to Ranjeet's wealth management firm and I have been very happy.

The staff who have dealt with me have been terrific, really excellent customer service.

I couldn’t fault them whatsoever and I would thoroughly recommend them.

CASE STUDY 21

Raghbir Mamak, Retired, Chelsea

"I am very happy how they are dealing with my portfolio.."

I only came across them as a result of one of the seminars. I was impressed and then decided that I would give part of my portfolio for them to manage.

The performance in the initial period was not that hot, but the tip my advisor gave me was brilliant at the time of Brexit and after that I have not looked back.

I have no hesitation in saying that I am very happy in how they are dealing with my portfolio and I look forward to their continuing and expanding my investments in my portfolio for the future.

CASE STUDY 22

Peter Janzen, Benfleet

"..I therefore have no hesitation in recommending them.."

I have been investing in stocks and shares for the last 10 years with an asset management company. My investments with this company have not performed as well as I hoped they would.

After receiving some financial advice and researching into other investment companies, I decided to transfer my investments to them.

Since investing with them, I have been impressed with the service received and with the performance.

I therefore have no hesitation in recommending them as a reliable company to handle my future investments.

CASE STUDY 23

Rob McGhie, Trader, Morden

"..I am happier altogether."

I had a policy with Old Mutual Wealth but it was not performing as I was hoping.

Ranjeet and his team have put together a strategy that I am happier with altogether.

CASE STUDY 24

Jim Downes, Retired, Derby

"..always helpful, prompt and professional."

I have invested in the stock market conservatively for many years but I wanted to speculate with a small part of my portfolio. I didn't have the knowledge or confidence to do it myself so I asked London Stone to assist.

All the staff I have been in contact with are always helpful, prompt and professional with their assistance.

CASE STUDY 25

Martin Bourne, Retired, London

"I want to deal with people I can trust."

I want to deal with people I can trust. I am always greeted with a nice smile and the people at London Stone will listen to you.

It’s nice to come in and be surprised by the friendly atmosphere and good information.

CASE STUDY 26

John Hillman, Horley

"I was very impressed with their offering, flexibility and knowledge..."

I was very impressed by their offering, their flexibility and their knowledge about markets. I’ve been very happy with them.

I get regular contact over the phone where I can monitor and watch my investments, so I know what's going on all the time

CASE STUDY 27

Ashley Coles, Retired, Cambridge

"On my first trade I am showing a 15% gain..."

After enrolling on the 30 day DIP course, I have built my own spreadsheet and on my first trade I am showing a 15% gain.

The best thing about the course is that it teaches you how to do the financial analysis on how to pick shares.

CASE STUDY 28

Ken White, Business Director, Westcliff-On-Sea

"..Very impressed indeed!"

Excellent reading would have been wonderful to the start of my investment journey if I'd started 45 years ago!

Very impressed indeed!

CASE STUDY 29

Michael McGowan, Retired, London

"..It's not a get rich-quick book....written for anyone to understand, with no special jargon.."

Dividend Income Plus shows how, by ejecting emotion and feeling and newspaper pundits' recommendations, one can use available facts and figures and some ordinary, everyday maths to make money on the stock market with part of one's savings.

Written by Ranjeet Singh, who, having worked for big institutions like banks, set up his own stockbroker firm which now has many clients, partly due to his DIP investment method.

Each chapter has its "Oh yes" moment where one realises how to avoid mistakes following the herd and instead use facts to calculate when to buy and when to sell.

It's not a "get rich quick" book. It's a "how to steadily increase your savings and handsomely beat inflation over the long term" knowing that even in a recession one can still make money.

It's written for anyone to understand, with no special jargon or techniques and you can read it through but to be sure you can get it right you'll need to read some chapters several times and try out the calculations on shares of some of the publicly quoted companies - before actually investing - to check it works.

It won't take a long time.

One reservation is that there's a gap in the sums. Having understood how to work out the risk, the next step is to calculate the minimum dividend you need to reward you for taking that risk - and you don't invest until you hit it - you're an investor not a gambler.

But Ranjeet says work out your own "table" depending what you're comfortable with.

Then you own the process.

I wanted more guidance, but the book guides you 90% of the way and shows it is not just the wealthy who can make money on the stock market.

CASE STUDY 30

Andrew Farrell, Student, Hackney

"..a really helpful took in my trading journey..."

The DIP has been a really helpful tool in my trading journey. It manages to capture the common mindset of a trader, take all of the confusing jargon, and break it down in very simple terms.

Honest and open, it makes for an interesting and informative read, providing key nuggets of information to aid the reader.

A great tool to have in your back pocket (or on the bookshelf!).

CASE STUDY 31

Peter Robinson, Retired Business Owner, Kent

"..interesting, thought-provoking and informative.."

Whether you are new to investing in equities or a veteran you will find Ranjeet's book interesting, thought provoking and informative.

Definitely worth a read.

CASE STUDY 32

Kevin Parry, HR Officer, Walsall

"(the DIP Book) was possibly the best investment I made this year...I made 12% profit in less than 3 months.."

I came in to investing later on in life, after receiving inheritance money. I wanted to carry on my late Fathers love of investing in safe blue-chip companies.

I have set out my own passive portfolio of traditional buy and hold dividend paying shares, mixed with a few ETF’s and a couple of investment trusts to hopefully provide me a future income.

I also wanted to generate extra short-term monthly income and after reading many books, I discovered Ranjeet’s DIP book.

This was possibly the best investment that I have made this year, a free book for the price of postage. I have read the DIP book from cover to cover and also watched the informative videos on the DIP strategies.

Using the DIP formula, I opened an account with AJ Bell solely for my DIP investments. I tested the waters with buying Greggs and BAE and made a 12% profit in less than 3 months.

I now feel comfortable to increase my stakes and I have shortlisted ten number FTSE 100 and five number FTSE 250 companies to invest in and are waiting for them to hit my buy price.

My aim is to generate a monthly income from the DIP which will complement my traditional buy and hold investments. Thank you, Ranjeet and your team.

CASE STUDY 33

Richard Ingham, Cheshire

"the DIP has been perfect in giving me the confidence…. "

Having previously been a buy and hold investor, the DIP has been perfect in giving me the confidence to take greater control in proactively managing my investments and significantly boost my return.

I've completed the 30-day online course and read the DIP book and found them both to be well explained and very informative.

The insights on interpreting share price movement and market trends that Ranjeet shares with his readers and the decisions he made in actual trades have been invaluable.

CASE STUDY 34

Rowan Butkevic, Trader, East Ham

"I like how this guy delivers the information...I'm giving it 5 Stars."

The book was very informative, I like how this guys delivers the information.

That's why I'm giving it 5 Stars.

However, as a trader myself, I didn't learn a lot of new things. It's better for people who want to learn trading/investing

CASE STUDY 35

Manish Ladwa, Retired, Twickenham

"The DIP Book is a great help towards learning the strategy."

Thanks for all the advice you gave me a few days ago.

It was nice meeting you all at the IX Investor show and I really found your presentation very helpful.

The Dividend Income Plus book is a great help towards learning the strategy.

CASE STUDY 36

Darren Lambourne, Consultant, Leeds

"The DIP is a brilliant book and it made a lot of sense to me."

I have a SIPP which is managed by my financial advisor and to give him credit, he's doing a pretty good job. My own ISA however is not doing as well and so after reading the DIP Book I realised one of the biggest mistakes that I was making.

My strategy was focussed on dividend income only so I've always thought that the 'buy and hold' strategy would be best.

But after reading the DIP Book it made me rethink. I now realise that I should be looking for growth and income, not just looking to maximise dividends. That means I should be more active and not just holding stocks for forever and a day. The DIP Book is a brilliant book and the strategy made a lot of sense to me. I'm not an experienced investor which is why I like the DIP because it's simple and methodical.

Recently I had my portfolio reviewed by London Stone and it was really helpful. They gave me some sensible suggestions of how I could increase my dividends but also reduce my exposure to some of the higher risk stocks in my portfolio. I'm going to try and implement the DIP strategy and really take control of my finances finally. Wish me luck!

CASE STUDY 37

Saunjae Lewis, London

"...With this book, you are GUARANTEED to learn something new"

This book is absolutely exceptional! “Dividend Income Plus” by Ranjeet Singh is the epitome of guidance and preparation for the financial markets. The chapter that I found particularly useful is chapter 4, which outlines that “trading is approximately 70% mental toughness and psychology and only 30% about the actual technical factors”. This is testament to my own personal experience, and is particularly useful for early traders, who often neglect the psychological impact on trading successes. The book delivers detailed information, outlining an in depth method to stock selection, including important company insights and ratios, and valuable guidance on risk management. With this book, you are GUARANTEED to learn something new!

CASE STUDY 38

Mike Down, Retired, Bristol

"I don’t need to spend any time worrying about my SIPP anymore."

I like them because they adopt a fairly safe and cautious approach.

I was with Hargreaves Lansdowne for 20 years before joining them but I wanted somebody to help me manage my investments to give me more time so that I could enjoy my retirement without neglecting my share portfolio.

It’s been exactly as I’d hoped.

The portfolio is doing just fine with a fairly low-risk strategy and I’ve been able to get on with the things that really matter to me.

Every so often I take some money out when I need it and I make the occasional phone call to see how things are going but other than that I don’t need to spend any time worrying about my SIPP anymore.

CASE STUDY 39

Paul Read, Retired, Walsall

"...They are extremely knowledgeable in the market place.."

I have been with London Stone since 2015, I have always found them easy to talk to and found them willing to talk ideas through.

They have a genuine relationship with you and are extremely knowledgable in the market place.

I’m extremely sorry to be leaving them, but for personal reasons in the present climate this is a decision I have had to make. but if circumstances changed they are a company to return to.

CASE STUDY 40

David Keay, Retired, Bristol

"...They are extremely knowledgeable in the market place.."

I am aged 85 & rely on London Stone to follow the stock market whilst I enjoy sailing with my son.

My advisor anticipated growth in cycling & recommended buying shares in Halfords. Boris Johnson further promoted cycling with his announcement, adding to the fortunes of this company.

In consequence you were able to sell my holding after only 2 weeks at a net profit of 81%

Well Done Indeed!

CASE STUDY 41

Chris Chapman, Engineer, Swindon

"...I can look forward to a more prosperous future in an uncertain world..."

For some months, I have been unhappy with the wild fluctuations and relative poor performance of the funds held in my Pension SIPP.

After a meeting with Ranjeet and his team, and a further period of reflection over Christmas 2019, I cautiously decided to move my Pension Funds to them.

The administration costs agreed with Ranjeet were more in line with my original annual costs with my long standing FA, who had recently retired.

My cash has now been re-invested and is already showing returns of some £16k in a period of under two months.

Although early days, I am feeling more confident despite the current headwinds of Corvid 19 and the final stages of Brexit and that I can look forward to a more prosperous future in an uncertain world.

CASE STUDY 42

Clive Anderson, Business Director, London

"...we have been able to accelerate my business.."

As a business owner I don’t want cash just to sit in my bank account.

That’s why I’ve been working with London Stone for more than 6 years and between us we have been able to accelerate my business.

The strategy is simple. I use cash which I’m not using within my limited company and invest it in the stock market.

Any profit that I make gets rolled up into the company’s profit for the year. It means that I now have two revenue streams – one from my business and one from the stock market.

In the past month Ranjeet and his team have made me more than 10% profit on my cash.

This is a most welcome addition to the prosperity of my business.

CASE STUDY 43

Mike Harris, Property Investor, Tonbridge

"...the focus is always on performance which over the past 5 years has been good.."

I am a private investor and have been a client of Ranjeet for nearly five years. One of their main strengths is the level of personal service they give to their clients in listening to, discussing and respecting the client's needs.

For me, It has always been an interactive service where we share and discuss investment ideas in a straightforward way.

Goals are mutually agreed and the focus is always on performance which over the five years has been good.

Ranjeet is always honest and will tell me if he thinks my ideas are wrong and I enjoy this level of interaction on my investments.

They feel like a true partner.

CASE STUDY 44

Roddy Cunningham, Sales Manager, Isle of Lewis

"...I was losing quite heavily on some of my shares and I wasn’t sure what to do.."

After the current stock market crash I was losing quite heavily on some of my shares and I wasn’t sure what to do.

I spoke to Ranjeet and and he gave me a number of strategies to reduce the risk of my shares falling further.

I chose the strategy to restructure my portfolio even though it meant taking a loss. In just three days the shares that I sold have fallen another 10% and the new shares that I bought have made me £2,800.

I’m still worried about the market crashing but I feel a lot more comfortable as I’m invested in companies and sectors which are greater protected against the coronavirus.

CASE STUDY 45

Ralph Brookes, Newquay

"...I'm very happy with what they're doing.."

I have been with London Stone since 2014 where I have found my advisors very approachable and prompt to my enquiries.

It’s a brilliant personal service that I haven't experienced anywhere else and their recommendations have also been very good so far.

I am very happy with what they are doing and looking to add more funds in the new tax year.

CASE STUDY 46

Norman Jones, Retired, Kent

"...I took their advice and saved thousands.."

The Coronavirus stock market crash would have really worried me if I was on my own but Ranjeet and his team called me before things got really bad and told me to sell some of my biggest holdings.

I took their advice and saved thousands.

I also sold National Express just before their big drop because of my advisor’s recommendation and then bought it back again at a much cheaper price.

I’m confident that I have picked the right firm to help me through these difficult times.

CASE STUDY 47

John Beyer, Poole

"...they have been absolutely brilliant...

performance has been much better than I had hoped for"

I was looking for somebody who could take care of our hard-earned savings.

Previously my wife and I were with the Nationwide and they never got in contact with us.

With Ranjeet's team, every time I ring up, I always can get through and there is great communication. I am thoroughly pleased with the service and they have been absolutely brilliant.

Customer service is the best that I have experienced and I would recommend them to anybody who wanted an honest, independent and personal service.

I can get advice when I need it and I can also make my own investments if that’s what I choose.

Regards to performance so far in the first 12months has been very pleasing and much better than I had hoped for.

Editor's Note - Apologies for picture quality.

CASE STUDY 48

Ron Williams, Poole

"...I'm now more active and reaping the benefits.."

Unfortunately I was unable to use Ranjeet's services because my portfolio wasn’t big enough.

However I followed their YouTube videos and found them really helpful and made some impressive percentage gains from their free tips and advice.

Most importantly it gave me the confidence to try new things and I’m now more active and reaping the benefits.

I still hope one day we can work together.

CASE STUDY 49

Chris Boulet, International Tax Expert, Woking

"...they genuinely care for their clients.."

I am a professional tax advisor well versed in finance. I therefore appreciate the need to find and establish an excellent working relationship with a investment advisor.

Ranjeet's stockbroker team one of the most professional firms that I have come across.

Their timing on recommendations is always good and performance is overall very good. Best of all they really don’t care about their commission, they actively say no to trading ideas and only select opportunities which they really believe will perform.

This shows that they genuinely care for their clients

CASE STUDY 50

Bob & Beryl Heape, Retired, Dorset

"...We've always had great faith in your integrity.."

We’ve always had great faith in your integrity, and have always been very happy with such a friendly service and knowing our money was safe.

After many years with your team, I’m saddened that we can’t invest with you any more, because we need the funds for a retirement village for me and my wife as I am now 85 years old and our health is not the best.

Beryl and I wish you and the team the best always.

CASE STUDY 51

Ben Tallack, Crypto Entrepreneur, Portsmouth

"...their trades match up with my own research."

I am very happy with Ranjeet and his team They are very knowledgeable, and I have confidence in their ability.

There are a lot of people in the financial world who can’t be trusted and but I’m an experienced, technical trader and I look at lots of indicators.

I can see that their trades match up with my own research which gives me confidence that they know what they’re doing.

So far the trades have all been profitable but the main thing is that I am building a long term relationship with this firm for the future.

CASE STUDY 52

John Boocock, Manchester

"...I would recommend the DIP Book to aspiring investors, and 13 Scams to everyone—because no one is immune to scammers."

DIP Book - I found this book to be a very informative and easy read.

The subject matter and strategy is logically and mathematically sound and also offers lots of useful information and food for thought. I also liked the fact that the basic principles of the book can be partially adopted even if not adopting the full strategy.

I would recommend aspiring investors to read the book.

13 Scams - A very informative book with very serious content and messages which has been skilfully written in a light hearted and entertaining style. I read the E book first and found it difficult to put down and was compelled to finish it as soon as I possibly could. I have also listened to the audio book and I found the narrator to have empathy and be in tune with the contents of the book.

I would recommend the book to everyone because no one is immune to the scammers!

We have helped over 700 UK investors through our FCA-regulated stockbroker firm from 2008-2024.

From 2025, and using the same trusted investment strategy, we can help you too.

We have over 16 years of experience running an FCA-regulated wealth management firm, covering a wide range of key areas, including:

• Client onboarding and suitability assessments

• IT systems and trading platforms

• Research and analysis to support your decisions

• Managing client portfolios

• Diversification to reduce risk

• Client communication and ongoing support

• Corporate actions and administration

• Statements, valuations, and tax calculations,

• IHT Mitigation

• Hedging strategies to manage market downturns

• Expertise in ETFs, funds, and global markets

• Dividend and capital growth strategies

And much more…

And it’s from this experience that we are able to help our clients through Market Insider.

We don’t give advice or recommendations, but we have extensive experience in all the areas where you may need support.

It’s not just about research to grow your share portfolio—it’s about everything else you need to succeed.

We offer a one-stop, full turn-key solution, either directly or through our trusted network of professionals.

That means no wasted time, energy, or money trying to fix problems yourself—we take care of it for you.

Ready to Join?

Whatever you’re struggling with - more income, higher growth, better diversification, lower taxes, or protection from a market crash - I’ve been there before. I know what works (and what doesn't), and I can help you fix it quickly.

Join Market Insider and get 12 months of unlimited support to help solve your financial challenges.

Copyright © 2025 | Terms of Business | Privacy Policy | Risk Warnings